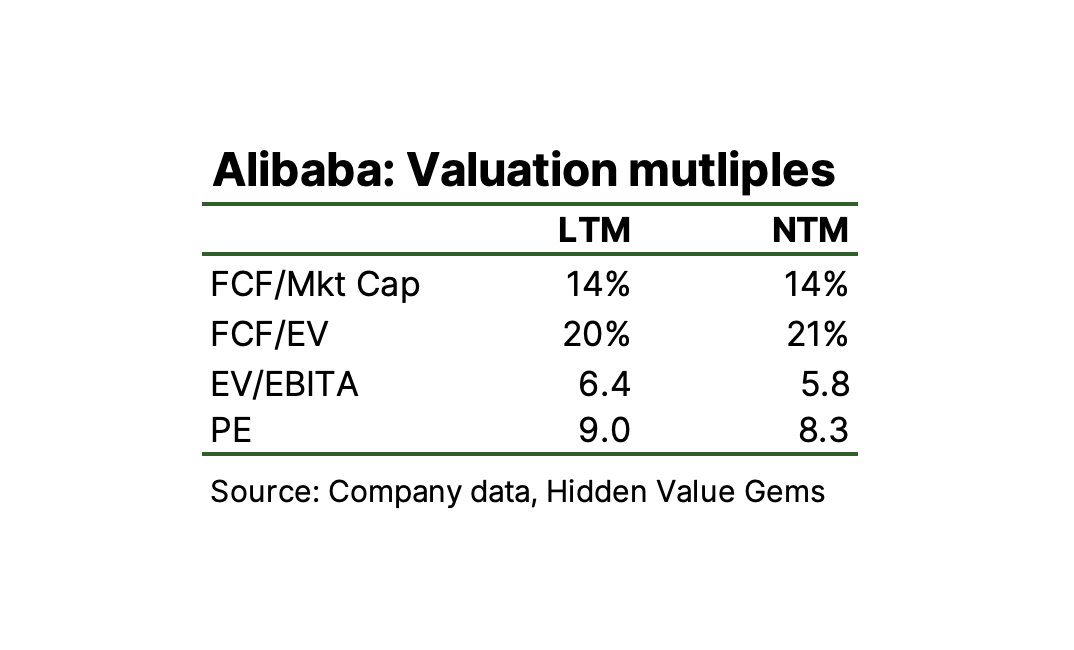

Valuation Multiples - Using LTM vs NTM Multiples in Valuation

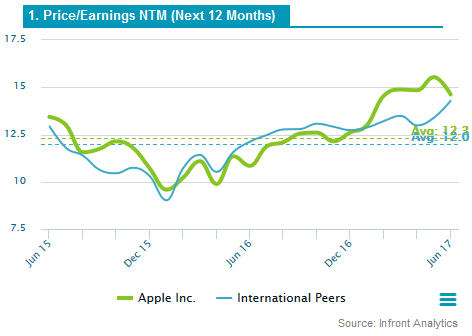

Financial analysts use LTM vs. NTM in looking at corporate deals, which serves as one of the fastest ways of valuing a business.

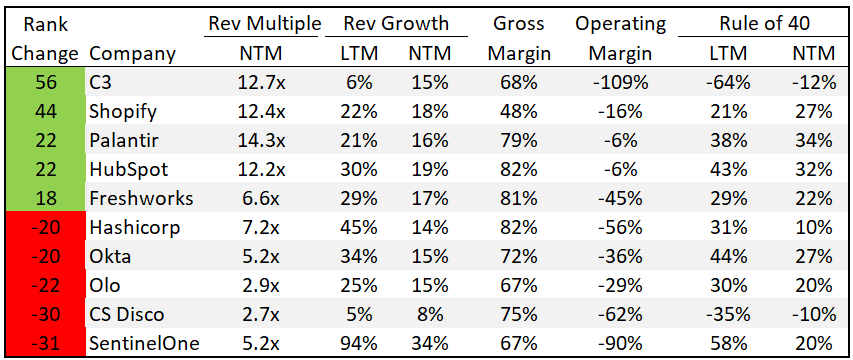

Big Movers - Public Software Trends - OnlyCFO's Newsletter

Fintech Valuation Multiples: 2024 Report – First Page Sage

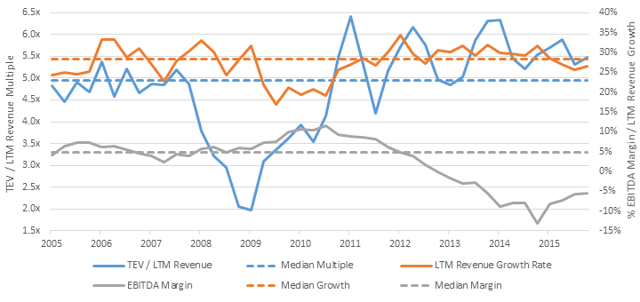

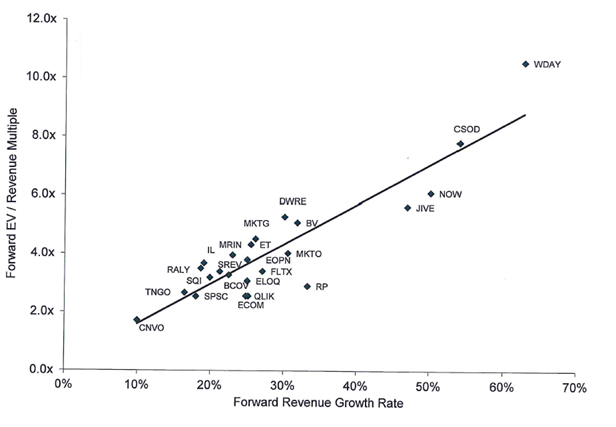

SaaS Investors: Mind The Valuation 'GAP' (Growth At Any Price

Alibaba: looking beyond low multiples

SaaS Investors: Mind The Valuation 'GAP' (Growth At Any Price

SaaS Valuation: The VC Proven Method To (Accurately) Value SaaS

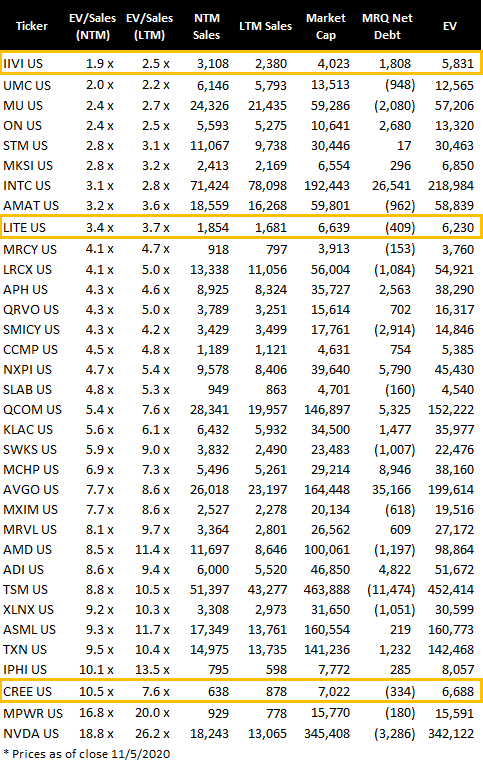

Semis Sector Consolidation: Multiples, Strategies, and Ideas

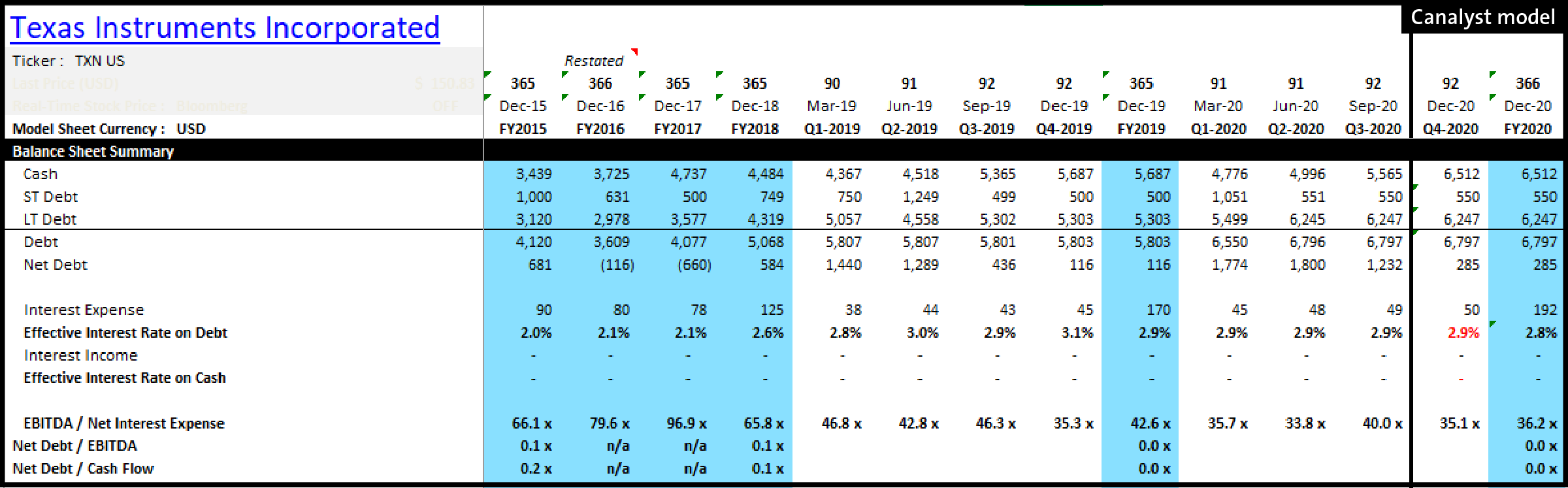

Quantitative Perspectives on Acquisition Targets From An M&A

Public Comps: Contextualizing SaaS Markets

Semis Sector Consolidation: Multiples, Strategies, and Ideas

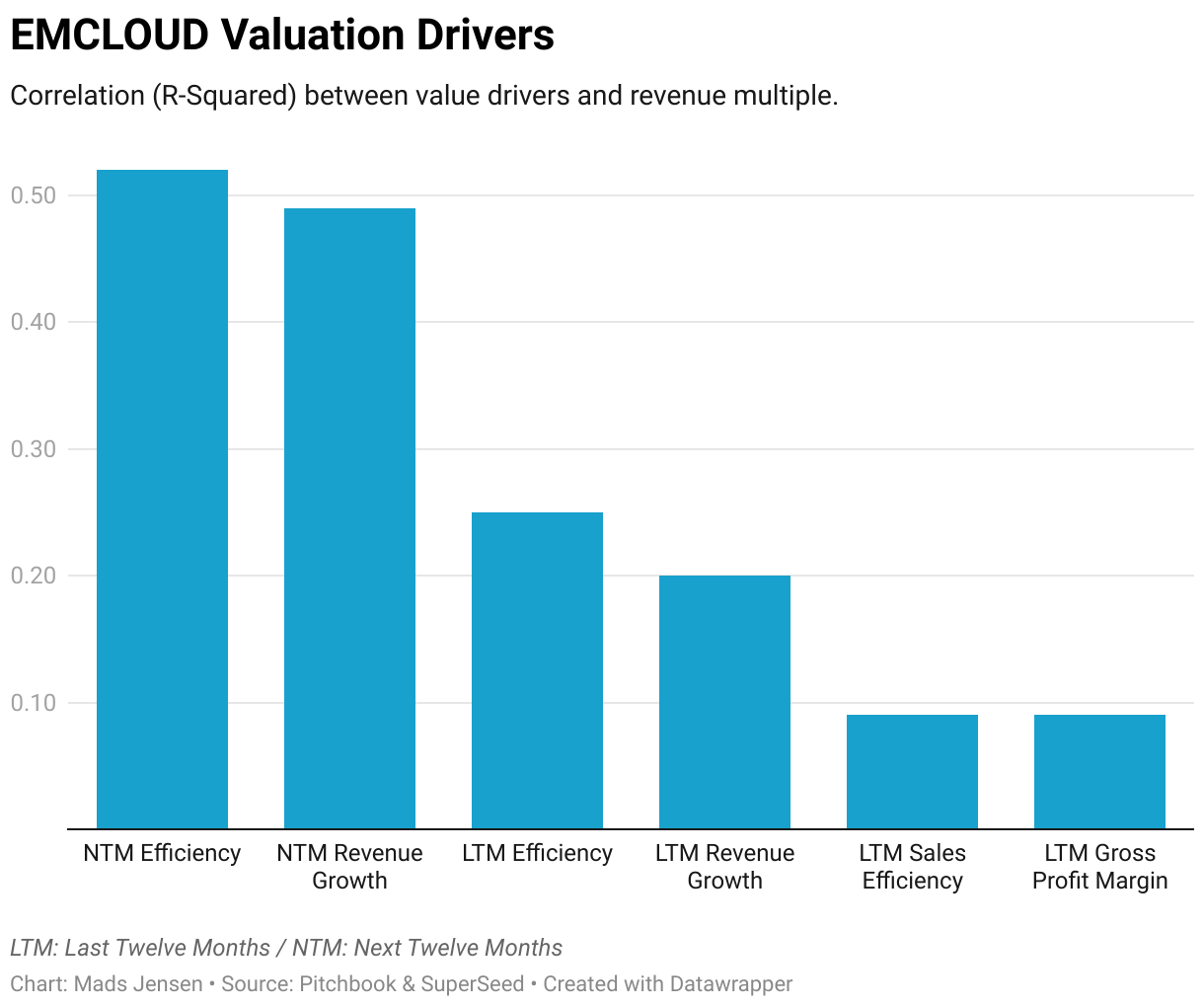

Growth for SaaS companies is back in vogue! - SuperSeed

Which multiples matter in M &A? An overview

NTM Meaning in Finance: Explained With Case Studies - Finance Detailed

Alphabet Inc.: Market multiple valuation (GOOGL, USA

Multiples Valuation: EBITDA Multiples