Portfolio trading breaks into new markets - The DESK - The leading source of information for bond traders

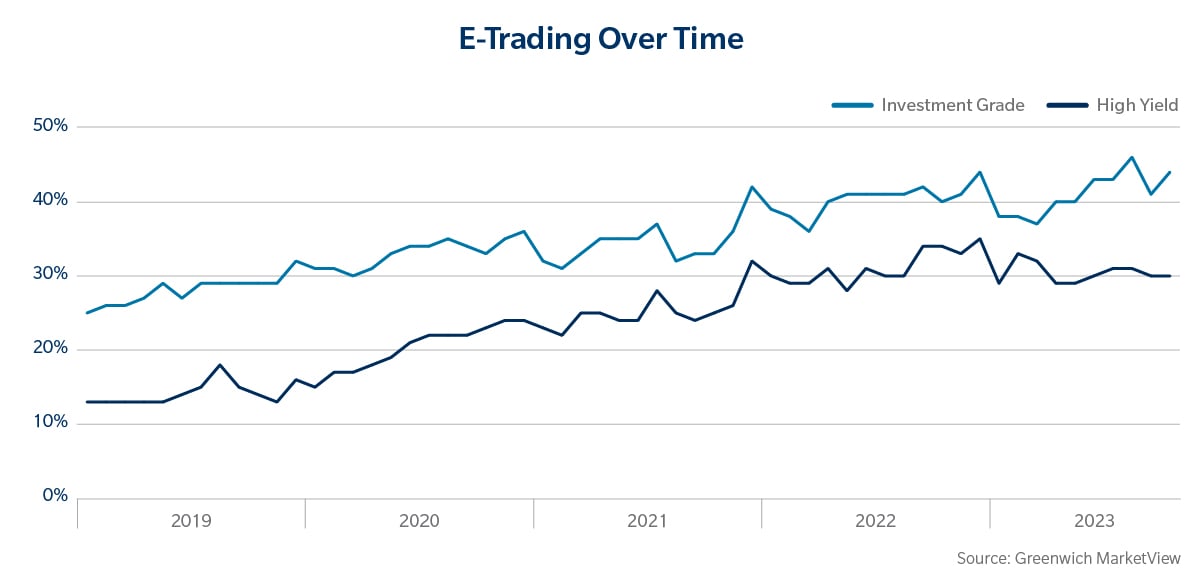

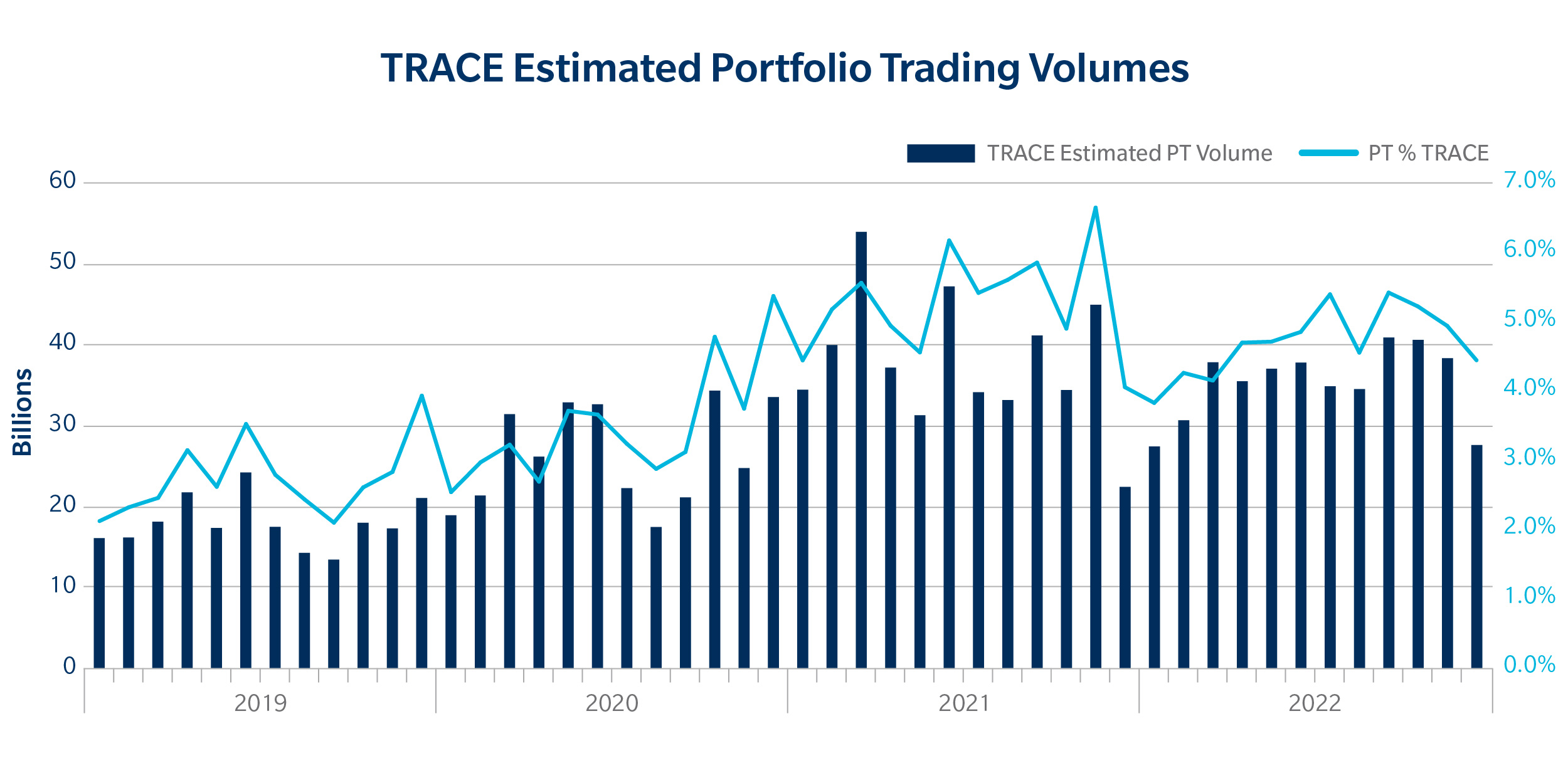

Emerging markets are adopting PT to add efficiency to liquidity sourcing, writes Matt Walters of MarketAxess. Portfolio trading has seen a lot of success and now it is expanding into emerging markets as part of its continued growth. Traders across the buy- and sell-side are finding new applications and situations in which it can be highly effective. TRACE data in the US indicates that portfolio trading volumes increased by US$100 billion in 2022 versus 2021. That was led by taking activity from voice trading. The growth of our own Portfolio Trading volume has also been rapid - in 2022 we

MarketAxess on LinkedIn: Portfolio trading breaks into new markets

Credit Hedge Funds: Industry, Trades, Recruiting, Careers

Portfolio trading just keeps growing - The DESK - The leading

Evolving market structure dynamics spurs new credit liquidity

Bond trading 3.0

Asset Classes Explained

Sales and Trading (S&T): Overview & Complete Guide (Update 2020

Stock market today: Live updates

Portfolio Trading: The next big thing for Asian bond markets

Portfolio Trading Trends: A Breakdown of 2022

Goldman Lost 2 Traders Then Accused Them of Accessing Secret Code

)