Action 4 - OECD BEPS

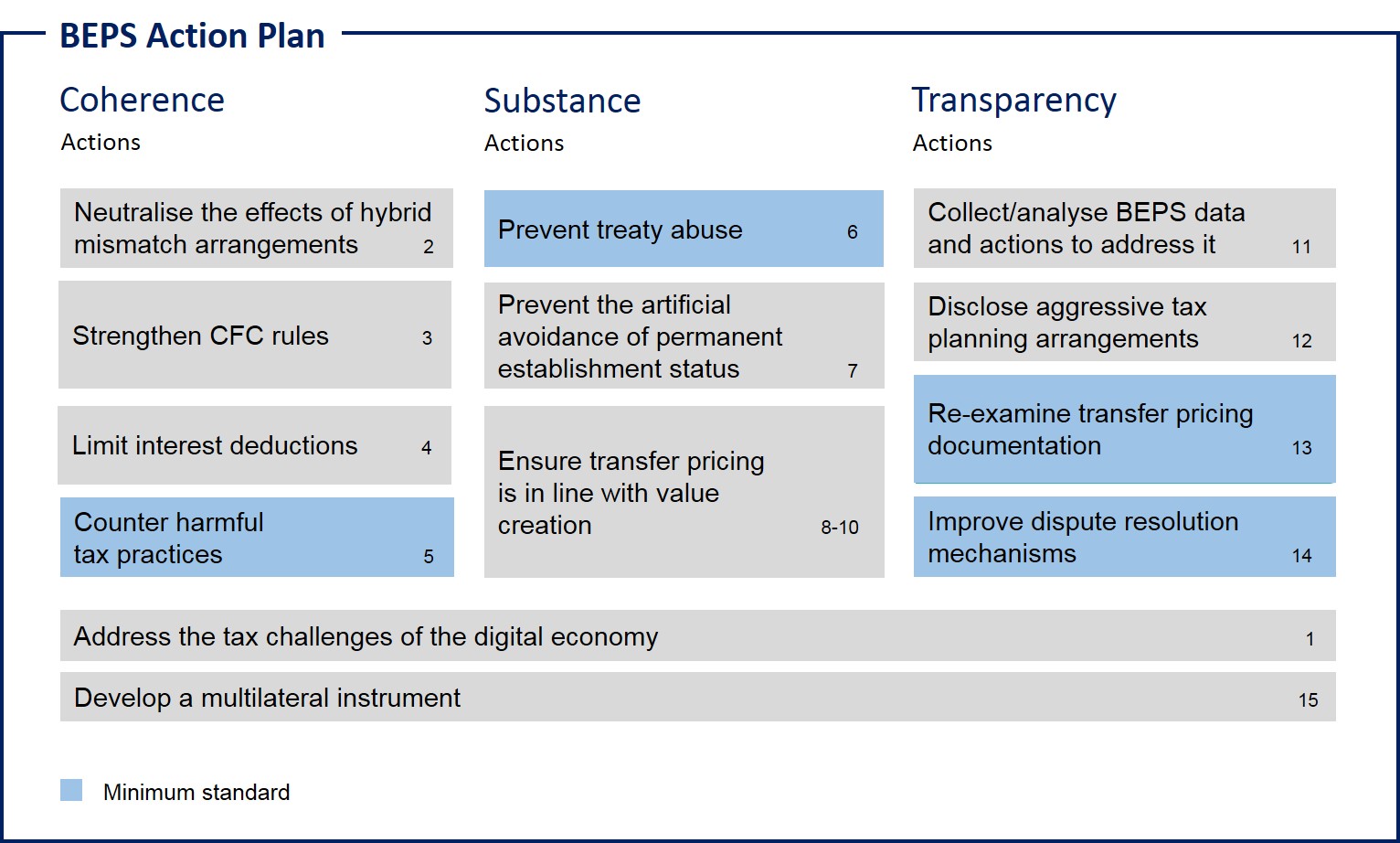

BEPS Minimum standards

Addressing base erosion and profit shifting (BEPS) is a key priority of governments. In 2013, OECD and G20 countries, working together on an equal

Oecd/G20 Base Erosion and Profit Shifting Project Limiting Base Erosion Involving Interest Deductions and Other Financial Payments, Action 4 - 2015

BEPS Reports - OECD

OECD BEPS and Tax Reform - ppt download

OECD reveals new multi-lateral instrument to enforce transfer pricing rules - CTMfile

OECD presents outputs of OECD/G20 BEPS Project recommending reforms to the international tax system for curbing avoidance by multinational entreprises - Sagasser Selas, Tax and Law Firm

BEPS Special International Tax Review

OECD released Transfer - IBFD Library & Information Centre

Home OECD iLibrary